Olivia: An AI App That Helps You Save Money

When you think of artificial intelligence platforms, or modern AI, what’s the first thing that comes to mind? Probably Alexa from Amazon’s Echo, Siri from Apple’s platforms, Google Now and maybe even Cortana from Microsoft.

Consider what these platforms are capable of. They are virtual personal assistants of sorts that allow you to carry out a variety of actions and events like sending messages, calling contacts, reading social updates and notifications and even buying products quickly.

But if you really think about it, and we mean really mull it over for a while, you’ll likely realize the things you can do with these platforms are kind of shallow. Alexa, for instance, will never be able to help you balance your finances and stay on top of your budget, at least not in her current form.

There is a tool you can use to budget your finances and save money, and wouldn’t you know it, it does have AI support.

That tool is a soon-to-be-released app called Olivia.

What Is Olivia?

Olivia is a financial assistant and personal finance app powered almost entirely by artificial intelligence. Olivia isn’t the first of its kind, but it’s certainly one of the most personable options available. Talking to Olivia is like talking to another person, not a computer.

You can sync up Olivia with nearly all of your financial accounts, including Venmo, Paypal and more. After a brief setup process, the AI will begin analyzing your behavior and provide insights on your spending habits.

For example, Olivia might show you how to save on your cell phone bill and take that money to roll into another bill that’s due soon, like your power or car insurance. The best part is that there are ways to save, even if you have nothing extra coming in or waiting in your accounts.

Ultimately, Olivia’s goal is to help you make smarter decisions with your money. It’s an excellent tool if you’re the type of person known for frivolous spending. Even if you’re not and you’re great a budgeting, Olivia will certainly make things easier for you.

But the way you use Olivia and the way she communicates with you is more unorthodox than what you’re used to when it comes to similar apps. You see, Olivia is a bot her developers label as a “financial friend” that you can text. That’s right, you text Olivia.

What Happens When You Talk to Olivia?

Okay, so it’s not actual SMS, as you’re still using a proprietary app to talk to Olivia, but it’s set up the same way. Basically, Olivia will send you messages just like a friend or colleague. You can answer her and get an appropriate response. You can also ask her questions of your own.

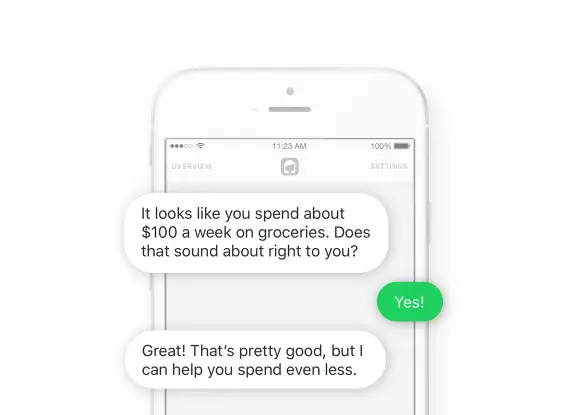

Here’s a quick example of an interaction with Olivia:

Olivia: “It looks like you spend about $100 a week on groceries. Does that sound about right to you?”

You: “Yes!”

Olivia: “Great! That’s pretty good, but I can help you spend even less.”

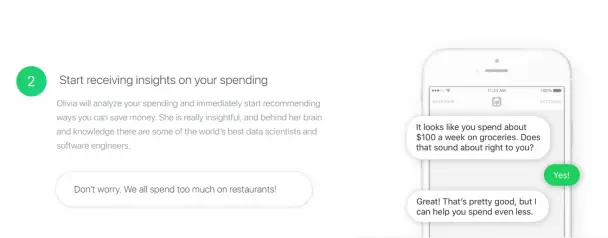

Olivia will analyze your spending habits and make smart suggestions based on where you can cut back spending and where you could save. How is this possible, you ask? Artificial intelligence, of course. Olivia is built on a system of algorithms that were perfected by data scientists and software engineers.

The Olivia team refers to themselves as “multidisciplinary,” which is short for a variety of departments. Software engineers are responsible for the brain, the data scientists educate Olivia and setup algorithms for the personal finance and cognitive researchers train her how to interact with humans. Finally, linguists showed her how to text in a more human way, and designers created the app and gave her an appearance.

How Does She Help You Save Money and Manage Finances?

Remember those algorithms we keep harping on about and the fact that Olivia can analyze your spending habits? Well, over time, she builds a personal profile of your finances and spending so that she can not only make suggestions for improvement but help you keep a tighter budget.

According to a Federal Reserve report, nearly half of all Americans can’t afford and emergency expense of even $400 without borrowing money or selling something to make it. That’s not good.

Having Olivia around is like having an accountant for your own personal finances and spending. Imagine being held accountable for what you’re doing with your money and how much you’re spending?

Think of all those times you said you were going to start putting away cash or saving and never did. Olivia might be the answer.

Images via Olivia.ai